Interest Calculator

An interest calculator is a financial tool used to estimate the interest earned or paid on an investment or loan over a specific period. It helps individuals and businesses understand how interest accumulates and impacts their finances. Whether you are saving money, taking a loan, or investing in financial products, an interest calculator simplifies complex calculations and provides instant results.

In this blog post, we will explore the different types of interest, how an interest calculator works, and why it is essential for financial planning.

Table of Contents

Types of Interest

There are two main types of interest calculations:

1. Simple Interest

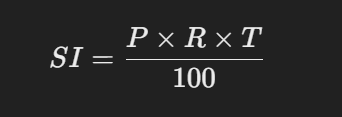

Simple interest is calculated based on the original principal amount. It remains constant over time and does not consider previously earned interest. The formula for simple interest is:

Where:

- SI = Simple Interest

- P = Principal amount (initial sum)

- R = Annual interest rate (percentage)

- T = Time (in years)

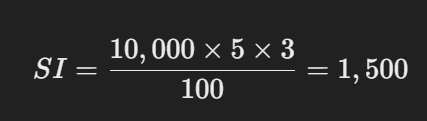

For example, if you invest $10,000 at an annual interest rate of 5% for 3 years, the simple interest earned will be:

The total amount after 3 years will be $11,500.

2. Compound Interest

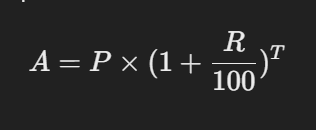

Compound interest is calculated on both the principal and the accumulated interest. It results in higher earnings or payments compared to simple interest. The formula for compound interest is:

Where:

- A = Total amount after interest

- P = Principal amount

- R = Annual interest rate

- T = Time (in years)

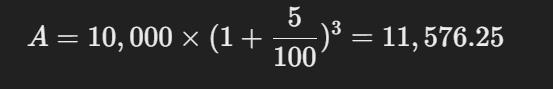

For example, if you invest $10,000 at an annual interest rate of 5% for 3 years with annual compounding, the final amount will be:

The compound interest earned will be $1,576.25, which is higher than simple interest.

How an Interest Calculator Works

An interest calculator requires three key inputs:

- Principal Amount – The initial amount of money borrowed or invested.

- Annual Interest Rate – The percentage of interest charged or earned per year.

- Time Period – The number of years the interest is applied.

By entering these values, the calculator provides instant results for both simple and compound interest. Some advanced interest calculators also allow users to select the compounding frequency (monthly, quarterly, or annually) for more accurate results.

Benefits of Using an Interest Calculator

1. Saves Time and Reduces Errors

Manually calculating interest can be complex, especially for long-term investments or loans. An interest calculator provides accurate results instantly, reducing the risk of errors.

2. Helps in Financial Planning

An interest calculator allows you to compare different investment options or loan repayment plans, helping you make informed financial decisions.

3. Estimates Future Earnings

If you are saving money or investing, an interest calculator helps predict how much your savings will grow over time. This is useful for retirement planning, fixed deposits, or stock market investments.

4. Useful for Loan Management

For borrowers, an interest calculator helps determine how much interest they will pay on a loan and how different interest rates affect monthly payments. This is helpful when choosing a mortgage, car loan, or personal loan.

How to Use an Interest Calculator Effectively

1. Choose the Right Interest Type

Determine whether you need to calculate simple interest (for short-term investments) or compound interest (for long-term growth).

2. Adjust the Time Period

Longer investment periods lead to higher interest accumulation, especially for compound interest. Use different time frames to compare results.

3. Experiment with Different Interest Rates

Changing the interest rate in the calculator helps you understand how small differences affect total earnings or payments over time.

4. Use Different Compounding Frequencies

If you are calculating compound interest, try different compounding periods (monthly, quarterly, yearly) to see how they impact the final amount.

Simple Interest vs. Compound Interest: A Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Growth Type | Linear | Exponential |

| Interest Applied | On principal only | On principal + accumulated interest |

| Returns Higher Over Time? | No | Yes |

| Common Use Cases | Short-term loans, fixed deposits | Savings accounts, long-term investments |

As seen in the table, compound interest provides higher returns over time, making it the preferred option for long-term investments.

Quora

Real-Life Applications of Interest Calculators

1. Savings and Investment Planning

Investors use interest calculators to estimate how their savings grow over time in bank accounts, mutual funds, or fixed deposits.

2. Loan and Mortgage Calculations

Homebuyers and car buyers use mortgage and loan calculators to determine monthly payments and the total cost of a loan.

3. Business and Financial Management

Businesses use interest calculators to plan financial strategies, estimate profits, and analyze investment returns.

4. Credit Card Debt Analysis

Individuals can use interest calculators to understand how much interest they will pay on credit card balances and plan repayments accordingly.

Conclusion

An interest calculator is a valuable financial tool that simplifies interest-related calculations and helps individuals make better financial decisions. Whether you are an investor, borrower, or business owner, using an interest calculator can help you plan savings, compare loan options, and maximize returns.

By understanding how simple and compound interest work, you can make smarter financial choices and optimize your savings or loan repayments. Always consider factors like time period, interest rate, and compounding frequency to get the most accurate results.

Loan Calculator